tax benefits of retiring in nevada

Nevada corporations may issue stock for capital services personal property. How Soon Can You Retire.

Nevada Tax Advantages And Benefits Retirebetternow Com

TAX RATING FOR RETIREES.

. COST OF LIVING FOR RETIREES. 3 in its list of the most tax-friendly places to retire. The exemption increase will take place starting in January 2021.

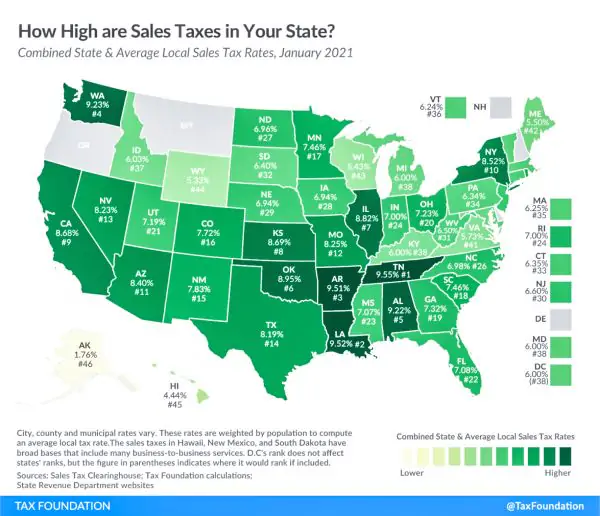

In the top 10 of states according to data from NOAA. For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest. Retirees in Nevada are always winners when it comes to state income taxes.

The state is phasing in a military retirement income deduction over four years. Nevada has far more sunny days and lower humidity to enjoy them than most states. The state of Nevada does assess taxes on property.

Only 16 miles from the Las Vegas strip Henderson is a great place to retire if you want suburban life only a short drive from the action. Regular Members Years of Service Regular Members Age of Retirement. Tax benefits of retiring in nevada Saturday June 11 2022 Edit.

Nominal Annual Fees. Simply just multiply the property tax rate by the your assessed value 032782 district tax rate x 87500 your assessed value 2868425. Increased the exemption on income from the state teachers retirement system from 25 to 50.

No Corporate Income Tax. Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most. Ad A Well-Rounded Strategy Can Go A Long Way To Help Prepare You For Your Financial Future.

Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. State Income Tax Range. PER CAPITA INCOME FOR POPULATION.

Jackson Can Help Prepare You To Speak To A Financial Professional. The property taxes assessed on an average-priced home in Nevada is 1423 per year according to Kiplinger which ranked Nevada No. Nevadans also dont pay sales tax on home sales food medicine and other items.

The Silver State wont tax your pension incomeor any of your other income for that matter because it doesn. Up to 54544 for joint filers to 298 on taxable income over 27272 for single filers. The Official State of.

No Franchise Tax. Youll Likely Pay Less in Taxes. 255 on taxable income up to 27272 for single filers.

Get Personalized Action Items of What Your Financial Future Might Look Like. Nevada also does not have a state income tax which is another benefit for senior citizens that reside in Las Vegas and are living on a budget. Public Alerts Amber Alert Nevada Silver Alert System Weather Alerts 211 - Service Information 511 - Road Conditions Fire Information.

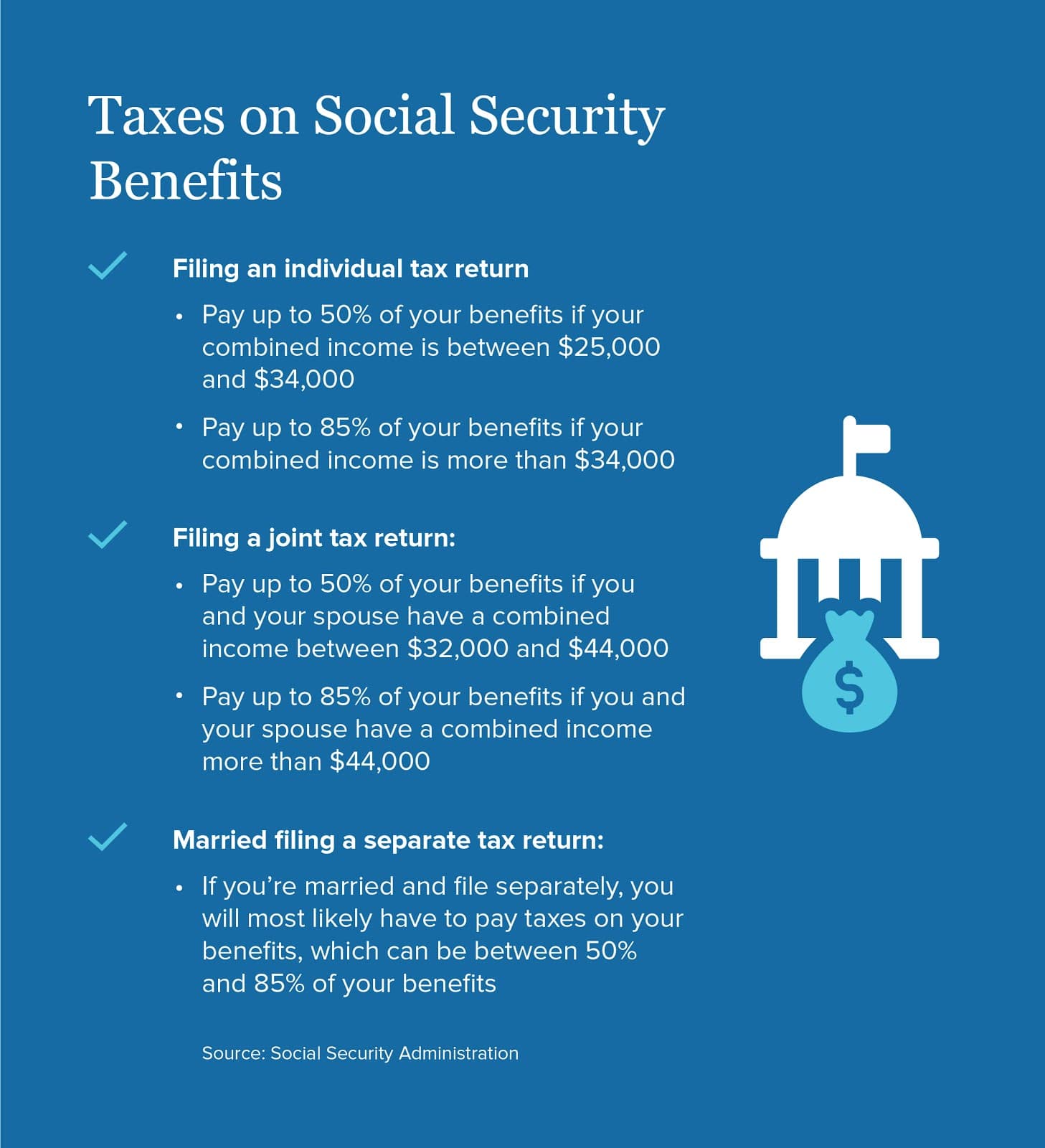

10 above the national average. 10 hours agoHi Larry I have applied for my Social Security retirement benefits to begin later this year when I turn 70. This change started rolling out in.

The Most Tax Friendly States For Retirees Vision Retirement Nevada Tax Advantages And Benefits Retirebetternow Com. However the amount of property taxes is not exceptionally high by most standards. Your property taxes would be calculated at 286843 per annum.

Your district is 200 and the in 2012- 2013 fiscal year the property tax rate was set at 32782. No Taxes on Corporate Shares. Nevada corporations may purchase hold sell or transfer shares of its own stock.

24 minutes agoUp to 50 of benefits are taxable for married couples filing a joint return who have a. Top Reasons to Incorporate in Nevada. All of that savings adds up especially with home sales.

1 How To Spend A Day In Scottsdale Az Arizona Road Trip Great Basin National Park Trip. If you have a 500000 portfolio download The Definitive Guide To Retirement Income. When I reached my FRA in 2016 I applied for my spousal benefits.

Regular Members Eligibility for Monthly Un-reduced Retirement Benefit. Ad Download The Definitive Guide to Retirement Income from Fisher Investments. SHARE OF POPULATION 65.

The lack of income tax is a huge benefit but wait. No Personal Income Tax.

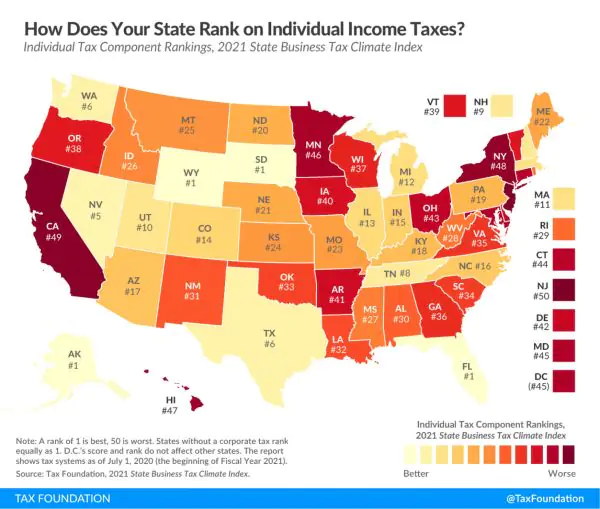

37 States That Don T Tax Social Security Benefits The Motley Fool

Nevada Retirement Tax Friendliness Smartasset

How To Reduce Taxes In Retirement Accuplan Benefits Services

Retiring These States Won T Tax Your Distributions

States That Don T Tax Retirement Income Personal Capital

How To Plan For Taxes In Retirement Goodlife Home Loans

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

How To Plan For Taxes In Retirement Goodlife Home Loans

7 Countries That Offer Tax Breaks For Foreign Retirees

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

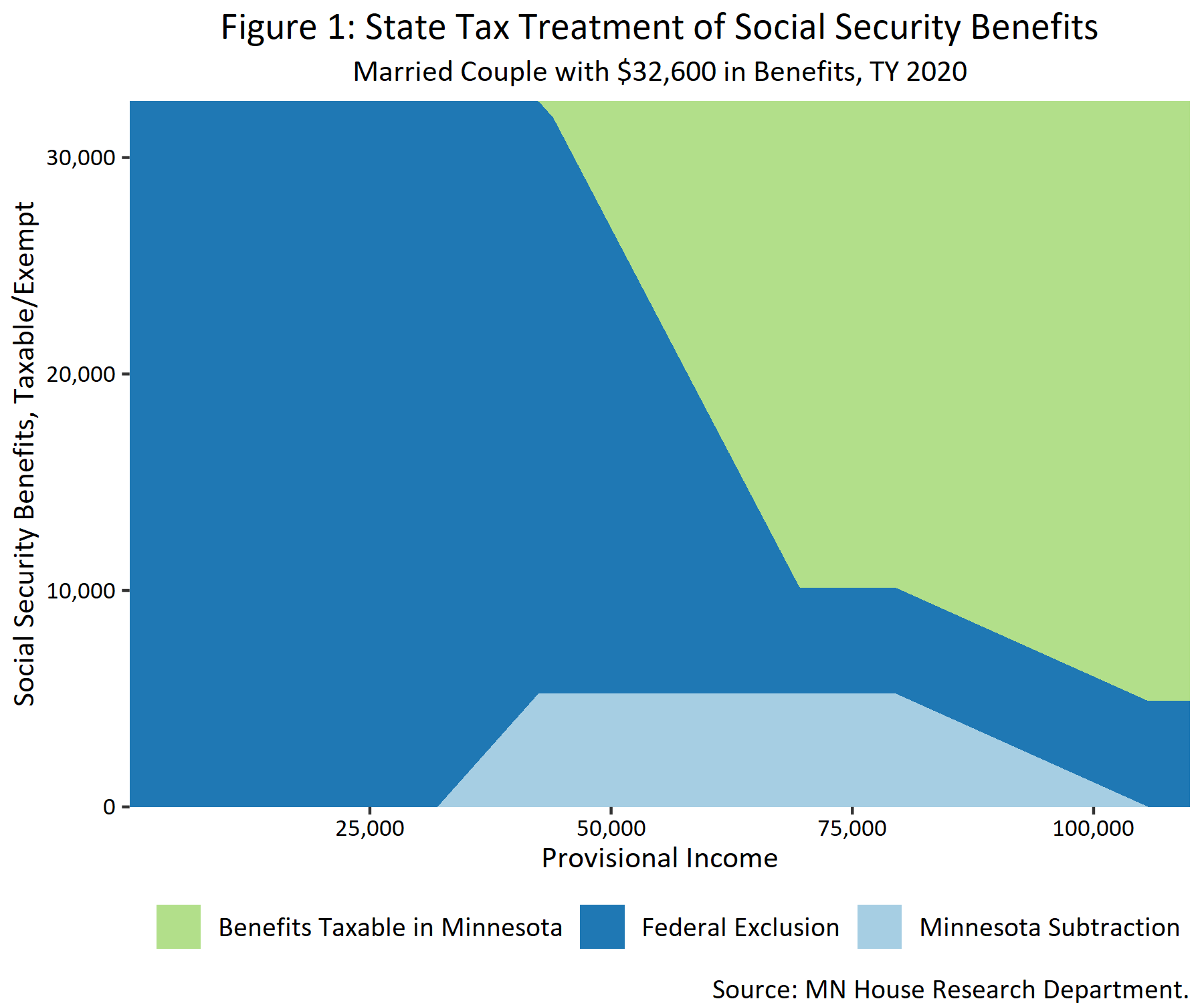

Taxation Of Social Security Benefits Mn House Research

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

Nevada Retirement Tax Friendliness Smartasset